what is included in a pastor's housing allowance

If your salary is 37500 and the housing allowance is 2500 for a total compensation. However it is also one of the most misunderstood.

Picture Of A Hand Opening A Door With Blog Post Title 2020 Housing Allowance For Pastors What You Need To Know Housing Allowance Allowance Pastor

An allowance designated by a church or other organization for its church professionals clergy for the expenses of providing and maintaining a home.

. In particular the exclusion from gross income can never exceed the actual housing expenses. For example suppose a minister has an annual salary of 50000 but their total housing allowance is. Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now.

Housing allowance the actual housing expenses or the fair rental value of the property. Include any amount of the allowance that you cant exclude as wages on line 1. The ministers housing allowance is an exclusion from income permitted by Section 107 of the Internal Revenue Code.

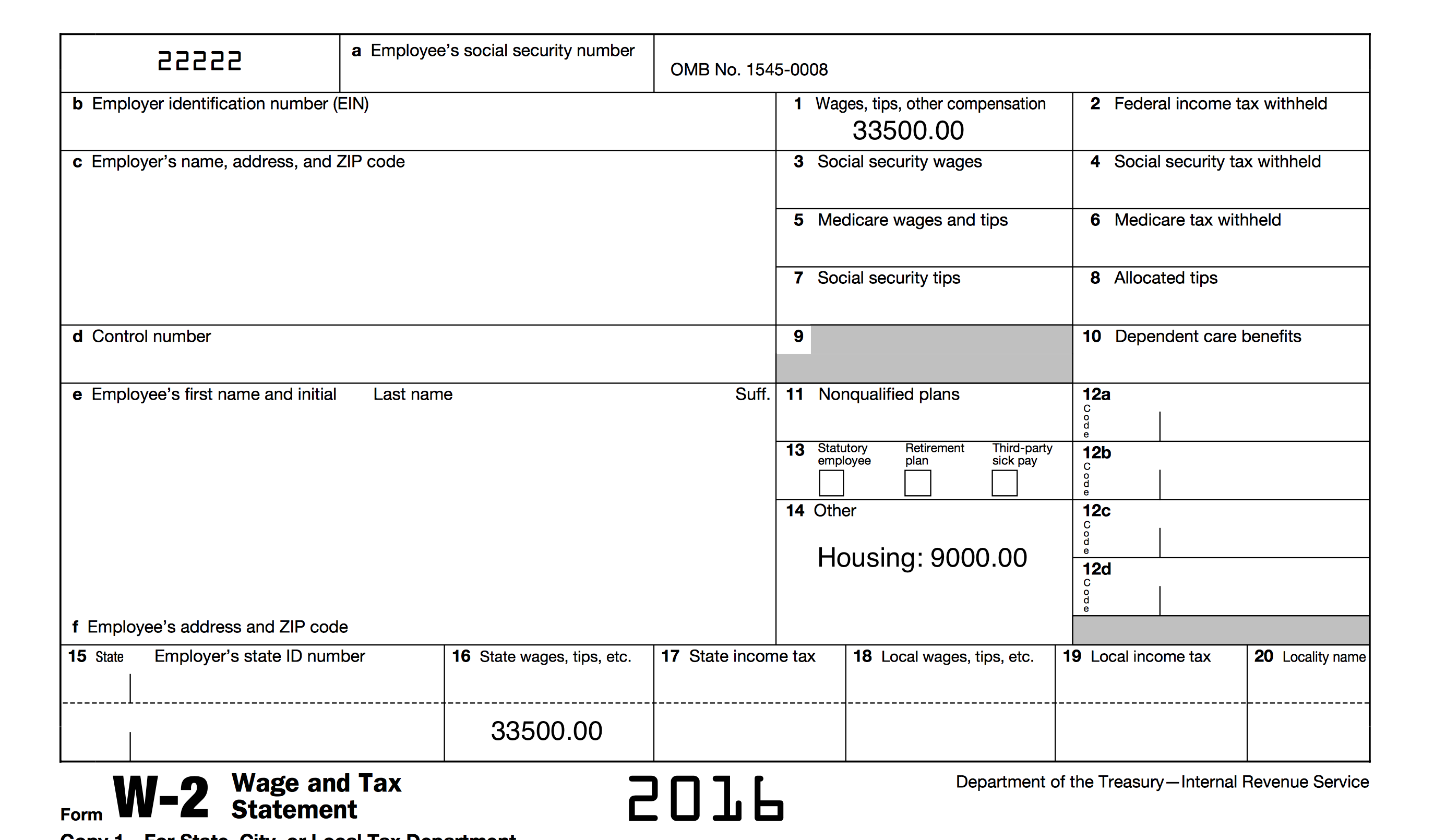

The ministers housing allowance is perhaps the best tax benefit among pastors. A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. The payments officially designated as a housing allowance must be used in the year received.

This Ver nuestro sitio en Español. Include any amount of the allowance that you cant exclude as wages on line 1 of. In addition this is saving pastors a total of about 800 million a year.

Miscellaneous expenses including improvements repairs and upkeep of the home and its contents snow removal lawn mowing light bulbs cleaning supplies etc. The amount paid by the church would go in box 14 housing allowance on the W2 as it is taxable for social security. This resolution basically states that until a minister can submit a housing allowance request for the balance of the year each paycheck issued to the minister will be X eg.

This housing allowance is not a deduction. The payments officially designated as a housing allowance must be used in the year received. In other words housing.

Benefits are given by the Church they are not controlled by the pastor. While up to 100 percent of compensation can be designated as a housing allowance the amount that can be excluded from gross income will not necessarily be the same. It is possible for ministers to request an exemption from self-employment tax for religious or conscientious reasons but it is not possible for economic reasons.

How To Set The Pastor S Salary And Benefits Leaders Church

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

How Much Should You Pay Your Pastor The Pastor S Soul

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

Are Pastors Homes That Different Christianity Today

Secular Jobs For Pastors Writing A Relevant Resume The Pastor S Wallet Resume Job Job Posting

Everything Ministers Clergy Should Know About Their Housing Allowance

Ultimate Guide To The Housing Allowance For Pastors Reachright

On Sale Now The Pastor S Wallet Complete Guide To The Clergy Housing Allowance The Pastor S Wallet

Five Things You Should Know About Pastors Salaries Church Answers

When Should A Pastor Request A Housing Allowance The Pastor S Wallet

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet